Inflation on Our Minds

In 2020, the amount of money in the U.S. economy increased by more than $4 trillion, a one-year increase of more than 26% in M2 - a measure of the money supply that includes cash, checking deposits, and easily convertible near money. Another $2.3 trillion (12%) increase is already built into Federal Reserve planning for 2021. That’s a lot of money.

According to the Fed, the purpose of the money is to spur the economy and drive employment up, moving money into the consuming public. The problem with this plan is that “created” money all too often ends up producing inflation. In 2009 and 2010, the Wall Street Journal reports that China’s money supply grew by 23%. By July of 2011, inflation had increased from 1.8% to 6.5%.

Many economists point to the lack of inflation in the U.S. to date as proof that the increase in M2 does not affect inflation. The U.S. at an average annual inflation rate of 1.8%, is still below the Fed’s 2.0% average inflation target. But there’s also not a lot of evidence that the new money has made it into circulation and had an opportunity to impact prices. Thanks to the Covid lockdowns and economic uncertainty, Americans have been spending less on non-essentials and saving more than ever. Banks tightened standards in 2020 for commercial and industrial (C&I) loans, along with many other lending products, because of the uncertain economic outlook, worsening of industry-specific problems, and reduced tolerance for risk. As a result, new loan originations faltered.

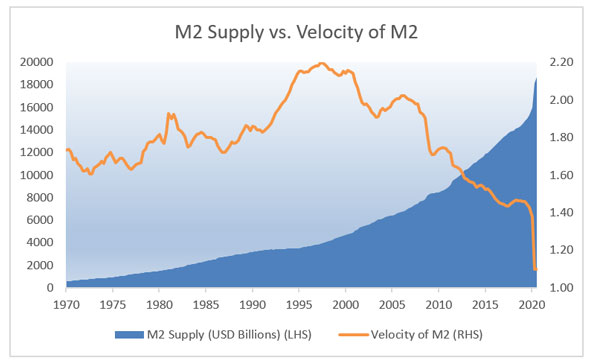

Velocity is a measure of the number of times that the average unit of currency is used to purchase goods and services within a given time period. For example, when you purchase a pair of shoes, your money may be used by the store owner to purchase more inventory, providing the manufacturer with funds to purchase more raw materials. Comparing the growth of M2 (money supply) with the velocity of M2, shows money creation has outstripped the willingness to spend. With velocity at an all time low, money isn’t making the world go round.

There is the belief at the federal level that increasing money supply is not inflationary. Fed Chairman Jerome Powell made clear on February 23, 2021, that he did not think increased stimulus spending would trigger higher inflation:

“Inflation dynamics do change over time but they don’t change on a dime, and so we don’t really see how a burst of fiscal support or spending that doesn’t last for many years would actually change those inflation dynamics.” …

But that doesn’t mean inflation is just a bogeyman of the past. It needs to be a very real consideration for investors.

In 2008, Warren Buffett called “exploding” inflation the biggest risk to the economy. Inflation, he explained, acts as a gigantic corporate tapeworm eating investment capital. Ronald Reagan put it a little differently, explaining, “Inflation is as violent as a mugger, as frightening as an armed robber and as deadly as a hit man.”

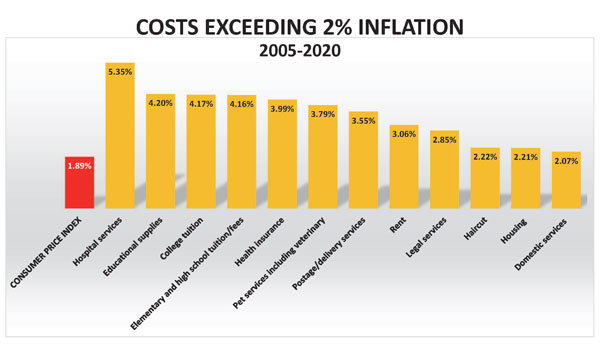

Recent increases in stock market volatility and short-term bond yields has a number of analysts concerned that the Fed will keep its “foot on the accelerator for too long.” Even with low velocity of M2, many spending categories of the CPI are already exceeding the Fed’s 2% inflation target.

Source: U.S. Bureau of Labor Statistics

The impact of inflation varies based on where you are in your economic cycle. Individuals over 50 who own their own home and cars and have minimal healthcare expenses may be least impacted. Inflation typically hits hardest on the poor, with the least ability to afford increased costs for basic consumables.

At present, Inflation is highest in what one might call aspirations – the desire for a college education, to own a home, to have affordable healthcare, to send one’s children to a good school, and even to have a pet.

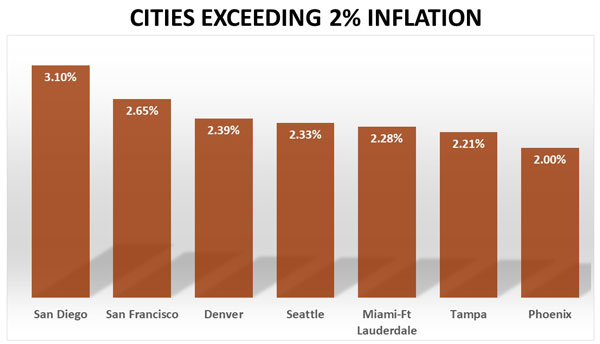

Inflation also varies by geographic region and municipality. Even now, areas of the U.S. are experiencing costs increasing at a faster pace than the national average.

Source: U.S. Bureau of Labor Statistics

Will or won’t inflation take off? Which monetary theorists will be right? Is there a limit to how much money supply and government debt can increase without rebounding on consumers? We will know the answers in hindsight. A better question may be - how can individuals best prepare if inflation is in our future?

Begin to think how you might best protect your investments. Research past inflationary periods to see which investments historically perform best in inflationary environments. Just remember that while past trends may recur, there are always variations on the theme.

Debt planning is one strategy. If you are planning on buying a home, auto, or other major purchase that will require financing, putting that financing in place now, while rates are low, may have value.

The fascinating aspect of financial markets is that there is typically a way to make a profit if you study and understand market trends and are flexible in your investment approach. Commodities and real estate have been effective inflation hedges in the past. Stocks of companies that are able to raise their prices faster that production costs increase can do well. Government inflation-protected bonds such as Treasury Inflation-Protected Securities (TIPS) are indexed to an inflationary gauge to protect investors from the decline in the purchasing power of their money.

Just remember, past performance is NOT indicative of future performance. Work with a qualified financial advisor. Ask questions before you make any major moves. And always have a plan to change directions if the scenario you are anticipating doesn’t materialize. Remember every investment has the potential for loss as well as gain, and not every investment strategy will be successful. A sure thing, or an investment too good to be true, most likely isn’t.

TOP

Cashing Out the Appreciation in Your Home

2020 left homeowners with a number of reasons to cash out on the appreciation in their home ranging from the desire to move to a new area of the country to record increases in their home’s value over the last few years, the ability to work remotely or even deciding to retire.

Another reason might be to take advantage of a tax break for homeowners included in the 1997 Taxpayer Relief Act. The legislation enabled homeowner couples to receive up to $500,000 in gains on the sale of their principal residence tax free. For singles, the tax break is $250,000. The home must have served as the owner(s)’s principal residence for two of the preceding five years.

Before 1997, homeowners had to “roll over” the proceeds on the sale of a home into the purchase of a new home to avoid capital gains taxes, or wait until age 55 to sell for a one-time opportunity to eliminate taxes on up to $125,000 of their accumulated real estate gains.

One key reason for taking advantage of the ability to cash out on your real estate gains now is that there is no guarantee how long this particular tax break will be around. The catch of course is that you have to make certain you have somewhere to live once you sell. Record price increases around the country are in part a result of a housing market with a limited inventory of homes for sale. Before taking any action, you also want to talk with your financial or tax consultant on how the sale will affect your overall financial position and your potential taxes.

TOP

Tax-Deferred and Tax-Exempt Plan Contribution Limits for 2020 and 2021

The following table shows the maximum individual/employee contributions allowed by the IRS, with the exception of the SEP IRA, where the company contribution limit is shown. Employer-sponsored plans may have different limitations. While contribution limits are largely similar among the different plan types, there are limitations as to who can and cannot contribute or deduct contributions based on income levels or participation in employer-sponsored plans. You may be able to use additional employer-funded plans if you have self-employment income. Distributions from traditional IRAs and employer sponsored retirement plans are taxed as ordinary income and, if taken prior to reaching age 59½, may be subject to an additional 10% IRS tax penalty.

* 401ks, Traditional and Roth IRAs, and Coverdell Education Savings Accounts have income phase-out ranges for determining tax deductibility or eligibility. Please check with your tax adviser or review literature on these retirement accounts to make certain you qualify. ** The maximum elective employee contribution is limited to $19,500 (under 50) or $26,000 (50 years and older) across all 401k plans in which the individual participates.

Employer sponsored retirement accounts are subject to limitations with respect to employee elective contributions. Employees classified as "Highly Compensated" may be subject to contribution limits based on their employer's overall participation and the participation of other employees. Check with your firm’s human resources department if you have questions about your plan. Anyone age 50 or older is eligible to make catch-up contributions. Employers are not required to permit catch-up contributions; however, since these contributions are not subject to nondiscrimination rules and eligibility is easily established, most permit catch-up contributions. The preceding information is not intended as tax or legal advice. Please check with your appropriate advisers if you have questions regarding your retirement accounts.

TOP

Online Threats from Scammers Are Booming

Over the past year, the email IN box has become an even greater minefield of threats to your financial welfare. It is a rare internet user who has not received:

- Threats of service cutoffs if payments are not made immediately,

- Invoices for products you never ordered,

- Sproofed emails from friends asking if you know who is in the attached image

- Requests for help making an Amazon purchase,

- SBA applications for pandemic loans,

- Notices of suspicious activity in your accounts that need to be verified,

- And more and more increasingly sophisticated scams.

Sometimes the scams are conducted through phone calls and, less frequently but still occurring, direct mail. The most effective often use a technique called “spear phishing,” including details about one’s personal life and relationships to make the recipient think the messages are 100% legitimate. Where do scammers get their information? Typically, from their victim’s online postings. We share far too much information about ourselves online, warn fraud prevention experts.

Online dating sites have also become a favorite of predators. Think your identification is confidential? Try a reverse image search on Google using your photograph and see what results you get (Go to images.google.com, click the camera icon, and either paste in the URL for an image you've seen online, upload an image from your hard drive, or drag an image from another window). Reverse image searches are also available on Bing and Chrome search engines. Armed with your name, a predator can look up other details, including work, hobbies and more, and use that information to create a persona that seems your perfect match. If you have questions about someone who says they know you, try a reverse image search on their photo. It may turn out to be a standard model shot or even someone altogether different.

Where do you start with protecting yourself from fraud?

- Limit information about yourself online.

There is no need for your online professional profile to include hobbies, mentions of your children or spouse. Don’t have Facebook friends you do not know personally. Limit information about you on business databases that could be used if the database is breached.

- NEVER EVER provide confidential information such as passwords, credit card or bank account information, social security number or even your address to an email address or online link included in an email or to a phone caller.

Log in direct to any accounts (retailers, social media, bank, credit card provider, etc.) that appear to be seeking that information, check your messages, and report the fraud.

- Verify the sender before opening any email attachments or links.

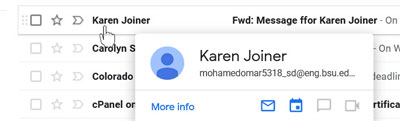

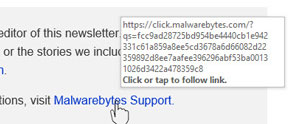

It is very easy to “spoof” or fake an email address. It is less easy to hide the information from a “scroll over” of the address or the address that shows up if you reply to the email. To scroll over an email, hover your cursor over the email address. The image below shows how an address scroll over appears on Gmail. In Outlook you can find additional information on the email by clicking FILE, then PROPERTIES.

Check the URL of any links in the email.

If you place your cursor on links within the email, Gmail shows the actual url at the bottom of the screen. Outlook opens a box with the link address. Don’t click on links in an email without first checking where they will take you. And don’t assume that a secured https: site is safe. The Anti-Phishing Working Group reports that 35% of all phishing sites were using HTTPS and SSL certificates. With Google now labeling non-HTTPS website as “Non-Secure,” expect to see more phishers abuse the accepted concept that HTTPS sites are trustworthy and legitimate.

Double check the legitimacy of any communication with a friend or by phoning the government organization or business before opening attachments or clicking links. This is your best protection. When it comes to contacting the organization, NEVER dial the number found in an email or left on a voicemail, as it could be fake. Search online for the organization for its correct contact number.

This information barely touches on the extent of email and internet fraud that exists today. And when it comes to fraud, you are on your own. There’s no anti-fraud insurance or government agency to protect you from a mistake. Once your money is gone, it’s gone. In the end, you have to protect yourself through what may seem like an excess of caution but is very necessary. The more you can learn about protecting yourself from email cons, the less likely you are to pay for a costly mistake.

TOP