We beg to differ…

One of the curious characteristics of the current administration and the people it has selected to head the federal agencies is their trust in technology over people. What seems to be emerging from the Department of Labor in its ERISA oversight of employer-sponsored retirement plans are the following fallacies:

- Robo advisors are good advisors and have lower fees.

- Assets in 401(k) plans are best left under the control of companies.

- 401(k) rollovers to IRAs are not in the investor’s best interest.

It’s time for a reality check:

• Robo advisors are only as good as their programming and the people programming them. They create primarily buy-and-hold portfolios and their programming is very much untested in the real world of today’s markets. Robo advisors are also a bit limited in the empathy zone and whether or not they can keep investors in the market through severe declines remains to be seen. Low fees are not necessarily related to good results.

• 401(k) plans have vulnerabilities as well as benefits. Once an employee leaves a company and no longer benefits from employer contribution matches, the benefits and drawbacks of staying with the 401(k) need to be carefully evaluated. Staying in a former employer’s 401(k) plan is not always the best decision.

• There are times when it makes sense to roll assets from a 401(k) into an IRA where the individual has greater control, typically more investment alternatives, a potentially lower fee structure and the ability to use professional management.

We believe investors have a right to information - from the philosophy behind their portfolio’s construction to the risk controls built into the portfolio design and how the portfolio has worked under market conditions such as we see today. That transparency is not readily available with the current state of robo advising. What if the programming behind the robo advisor is based on faulty premises? Are there checks and balances that will allow the portfolio to adapt and prosper?

The extent to which critical, experienced-based knowledge can be captured and codified through technology is still limited. Among the legendary investors, human intuition played an essential part. Humans seem to be able to decide the validity of statements that would stump us, were we strictly computers.

The Department of Labor under its ERISA authority has proposed that individuals and firms that advise 401(k) investors be held to a fiduciary standard. As registered investment advisors, we are already held to that standard and we believe it is in the best interests of our clients. But in trying to pin down the fiduciary concept, the DOL is proposing regulations that could dramatically limit financial advice. One proposal may restrict the ability of advisors to explain the pros and cons of rollover IRAs. In the event we find ourselves barred from this discussion in the future, below, we take a look at options and factors to consider when you leave an employer and have the option to rollover a 401(k) account to an IRA as a reference for today and in the future.

TOP

Settle Back for an Interesting Ride

“Volatility is not the enemy of the long-term investor. That investor’s response to volatility is.” – Josh Brown

If financial markets were truly efficient or truly random, there might be more rationale to a buy-and-hold approach. But every time investors begin to get complacent and venture a little further out on the risk curve, moving away from the concept of managing risk, the market provides a sharp reminder that risk matters. Late summer of 2015 was one of those reminders, but was it really a surprise? In January 2015, Ed Easterling of Crestmont Research maintained that “If history is again a guide, a surge to high volatility may not be far away.”

Easterling’s work, along with that of a number of mathematicians and technical analysts, have found in the market, patterns that rhyme. They are never an exact repeat of the past, but the similarity is there. “Markets have memories,” said mathematician Benoit Mandelbrot. But the news seems to come as a surprise to the financial media each time market volatility takes off.

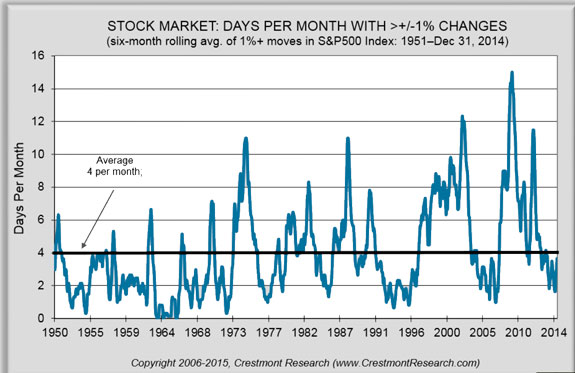

Volatility is the up-and-down movement of the market. As this chart from Crestmont Research shows, the S&P 500 (and other market indices as well) has historically moved from periods of low volatility to periods of high volatility. High volatility periods tend to be times of greater risk in the market. These are times when investors are more prone to emotional decisions, when hair-trigger computer programs can launch market moves and when negative news tends to carry more clout than the positive.

The chart above from Crestmont Research shows the pattern of low volatility periods followed by high volatility years.

When volatility falls below the historical average of four 1% moves in a year, high volatility may well be on the horizon. It’s just a question of how soon, how much and how long….

TOP

Planning Ahead for the Retirement Smile

What should your income requirements be in retirement? The recommendation used to be that one would need 75-85% of current income in retirement. Then, when advisors found their clients spending more than forecast, the recommendation went up to 100%. The latest look at planning for retirement shows more variability. For most retirees, spending starts out high, falls during the middle period, and then, as they age, once again climbs.

The early years of retirement are often the time of greatest activity, with travel and social activities high on the list of priorities. Costs taper off in mid-retirement with lower activity, only to rise again as health care costs begin to take a larger share of spending.

As a result, the retirement cost curve is shaped much like a smile.

And that smile also reflects the periods of risk to the individual. A portfolio loss early in retirement when withdrawals are relatively high can dig a hole from which retirees can never recover. Mid-retirement, when withdrawals are lower, may allow more aggressive investing, while a conservative stance may be more appropriate in the later years when the portfolio may not have time to recover from losses.

TOP

The 401(k) - When You Retire or Leave Your Employer

If your employer offers a 401(k) plan, you should take full advantage of the plan. Max out any contribution matches (where the employer provides funds to match to any amounts you contribute). Reduce your current income and save on taxes by funding your account up to the contribution limit. Ask for help if you need it in setting up your portfolio allocations.

But what should you do if you leave the employer or retire? There are four basic options that you can implement in full or partially.

- Take the money (or some of the money) in a lump sum,

- Leave the money (or some of the money) in the employer's 401(k),

- Roll the money (or some of the money - caution: not all 401(k) plans allow partial rollovers) over to an IRA,

- Or, if you have a new job where a 401(k) is offered, move the money (or some of the money, given the plan allows partial disbursements) into the new employer's 401(k).

Whether or not you have the ability to make partial transitions after you leave the company will depend on the plan rules. Make certain and review those rules before making any decisions.

(1) Lump sum distributions

Number 1 would be the costliest choice because you would owe income taxes on the full withdrawal plus a 10% penalty if you are under age 55. And, you will not receive your full balance. If you are not fully vested when you leave the company, employer contributions may revert to the company or be partially forfeited. Your former employer will also withhold 20% of your account balance to prepay the tax you’ll owe. The distribution could also put you in higher tax bracket, adding to the cost of cashing out.

You also need to weigh carefully how a distribution will affect your future retirement security. It’s easy to withdraw funds for a short-term loan, and then never replenish your retirement portfolio.

(2) You can leave your 401K account as it is in your former employer’s plan.

If you are satisfied with your plan, you have good investment options, low fees, and will continue to receive full service on your account, it can make sense to stay with your former employer’s 401(k) plan. 401(k) plans have a number of advantages over an IRA including:

- The ability to borrow from the 401(k) - provided the plan allows borrowing

- No early withdrawal penalties once you turn age 55 (this is 59½ with an IRA)

- Greater bankruptcy protection. Contributory IRAs are only protected against bankruptcy up to $1.17 million

- You can still rollover your funds to an IRA at a later date

On the flip side, your 401(k) plan is now held by a company with which you are increasingly unfamiliar. Staff changes, mergers, and even bankruptcy can make ultimately taking control of your assets more difficult. You will not be able to make ongoing contributions, you may lose your ability to borrow against your funds and you may also pay higher fees as a former employee.

(3) Roll your assets over into an IRA.

An IRA gives you the greatest control over your retirement funds. You select the custodian. Your investment options are much broader. You no longer have to invest under the rules and costs of the 401(k) plan. You can hire an investment advisor to manage your assets (most 401(k) plans limit your ability to use outside management). Required Minimum Distributions can be easier to calculate. You can also withdraw funds without a penalty for a first-time home purchase or to pay college expenses (you will still owe income taxes on the withdrawals). But you will not be able to borrow funds from your retirement account or withdraw funds prior to age 59½ without incurring a 10% penalty. Bankruptcy protection covers only up to $1.17 million.

(4) Roll your assets over into your new employer’s 401(k) plan.

Before you do this, investigate the plan. Does it accept rollovers? Does it have good investment options? What are the fees? Will you receive assistance making investment choices? Are there restrictions as to trading frequency, your ability to borrow funds, etc.? What are the company match and vesting requirements? Can you roll your rollover back out of the plan if you decide you would rather manage it through an IRA? If your new employer accepts rollovers, you may have to wait until the next enrollment period, or sometimes until you’ve been on the job a full year, to move your assets.

It is typically best to make a direct rollover to your IRA or new employer’s 401(k) plan. If you make an indirect rollover by withdrawing the funds in cash and then depositing them to your new retirement account, your former employee is required to withhold 20% for taxes. Provided you open and fully fund your new retirement account within 60 days, you would receive the 20% back when you file your tax return for the year. But in the meanwhile, you need to make up that 20% from other sources or it counts as an early withdrawal. Any pretax contributions and all earnings that you fail to deposit within the 60-day window are considered withdrawals and are taxable.

The biggest drawback of the 401(k) is often its self directed nature. In an effort to avoid fiduciary liability, most companies provide little investing direction or advice. As a result, inertia appears to rule. In 2014, only 10.5% of plan participants changed the asset allocation of their account balances, and just 6.6% changed the asset allocation of their contributions despite the fact that changes were undoubtedly happening in their lives. If a rollover to an IRA opens the door to better financial advice that should be consideration in your decision as to what to do with your 401(k) assets.

This is a relatively brief overview of your 401(k) options. For more information, please contact our firm and we can walk you through the different scenarios you have.

TOP

Financial Tips and Insights

Don’t overfund 529 accounts. Overestimating how much college will cost could lead to overfunding 529 accounts, and subjecting left over money to a 10% penalty and income taxes on earnings to pull it out of the account.

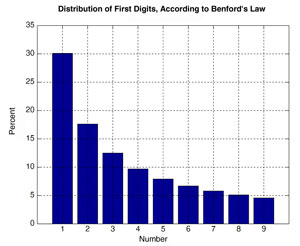

Detecting financial chicanery and accounting irregularities may be a matter of numbers. According to Benford’s Law, in naturally occurring sets of numbers of sufficient size the first digits are not evenly distributed. Lower numbers predominate: 1 is the first digit in a number almost 30% of the time while 9 begins less than 5% of numbers. Financial returns that fail to mirror Benford’s law have a higher potential to be fraudulent. The IRS uses Benford’s Law to sniff out possible tax cheats while Deutsche Bank is applying Benford’s Law to financial statements to target potential financial chicanery.

"If somebody tries to falsify, say, their tax return, then invariably they will have to invent some data. When trying to do this, the tendency is for people to use too many numbers starting with digits in the mid range, 5,6,7 and not enough numbers starting with 1. This violation of Benford's Law sets the alarm bells ringing.” Dr Mark Nigrini

Average up, not down. And instead of buying more shares of a stock when the price drops, you should "average up." Add to your winning positions. You want to buy positions that are going up, not spiraling down. There’s no guarantee a losing position will recover. Buy winners instead. This approach contrasts dramatically with modern portfolio theory, which deliberately sells winners and buys losers to keep a portfolio balanced, averaging down potential return.

Professional investors do have an edge. Greater experience with financial markets and confronting unusual market events on a regular basis makes the investor more likely to be able to regulate and control their emotions. This emotional control tends to make people better investors than others. Decisions are based on facts and market assessments rather than emotion.

To buy happiness, buy experiences. New material possessions provide a brief thrill; but experiences provide both more happiness and more lasting value according to research. According to one happiness researcher, people get more happiness by spending money on others.

Stability is itself becomes the cause of instability. The "Minsky moment," defined by economist Hyman Minsky, argues that the more comfortable investors are with a trend, the more it will persist, and then the more severe the correction will be when the trend suddenly fails. Minksy maintained that financial crisis are endemic in capitalism because periods of economic prosperity encourage borrowers and lender to be progressively reckless. Excess optimism creates financial bubbles that later burst.

“Three strikes and you’re out.” Sell on the third interest rate hike, not the first. Interest rate increases historically have taken a while to actually make an impact because of the lagging effect of higher rates. While the media is often fixated on when and even whether, the Federal Reserve will increase interest rates, many analysts believe initial rate increases will have little if any immediate effect on the financial markets. With that said, there’s no guarantee the rule will hold true this time.

TOP